- The Great Reset

- Posts

- December Week 4 - 2025

December Week 4 - 2025

( 1 ) Why Japan’s Shift Threatens a $20 Trillion Global Meltdown( 2 ) The Autonomy Revolution: How Tesla is About to Reshape the Global Economy( 3 ) The Psychological Shift Beyond the Price of One Bitcoin

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

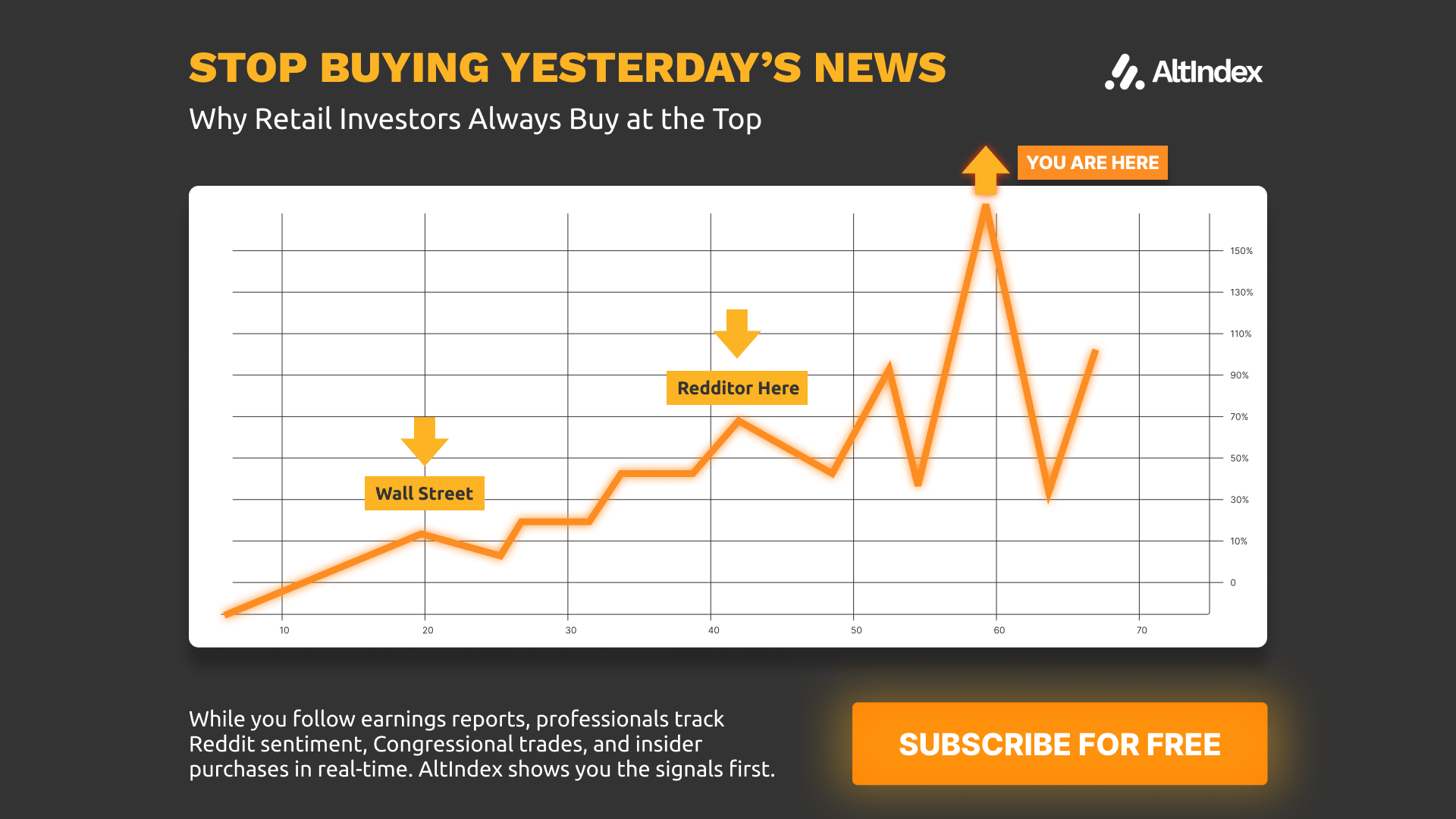

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Morning! 3 select reads to spark your week:

( 1 ) Why Japan’s Shift Threatens a $20 Trillion Global Meltdown

( 2 ) The Autonomy Revolution: How Tesla is About to Reshape the Global Economy

( 3 ) The Psychological Shift Beyond the Price of One Bitcoin

MONEY RESET

Why Japan’s Shift Threatens a $20 Trillion Global Meltdown

The global financial system is far more interconnected and fragile than most realize, and a major crisis is currently brewing in Japan that could send shockwaves through every major asset class. As the world’s fourth-largest economy and one of the largest holders of U.S. Treasury bonds, Japan acts as a silent driver of global liquidity. For decades, its central bank maintained near-zero or negative interest rates to combat stagnation following the massive property bubble collapse of the 1990s. This environment encouraged investors to borrow yen cheaply to fund higher-yielding investments abroad a practice known as the "carry trade".

This mechanism has financed trillions of dollars in global risk-taking, with exposure estimated at over $20 trillion. However, the math behind this massive leverage is now breaking. In early 2024, the Bank of Japan began raising interest rates, ending its negative policy and signaling a fundamental shift. When borrowing costs for yen rise, the carry trade is no longer "free money." Investors are suddenly forced to sell their international assets, including U.S. Treasuries, stocks, and cryptocurrencies—to buy back yen and repay their loans.

The danger lies in a "disorderly unwinding" where positions are closed all at once, leading to extreme market volatility. We have already seen the impact: early in 2024, initial adjustments caused a 6% slide in the S&P 500 and a 14% decline in the dollar against the yen. With the U.S. Federal Reserve cutting rates while Japan hikes them, the "interest rate differential" is narrowing, accelerating the pressure for traders to exit their leveraged positions. If Japan loses control of its bond market or currency value, the resulting meltdown could freeze global markets and trigger a crisis that few are prepared to face.

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

TECH RESET

The Autonomy Revolution: How Tesla is About to Reshape the Global Economy

The transition from human-driven vehicles to fully autonomous transport is no longer a distant vision; it has become a tangible reality. Recent developments in Austin, Texas, have signaled a major leap forward, with unmonitored vehicles successfully navigating city streets without a safety driver. This milestone marks the shift from supervised assistance to true Level 4 autonomy, a change driven by a fundamental pivot in software architecture: the move from hard-coded instructions to generalized neural networks.

Central to this revolution is the emergence of purpose-built hardware like the Cybercab, which leverages advanced die-casting and "unboxing" manufacturing processes to drastically reduce costs. By eliminating traditional components like steering wheels, pedals, and even paint, these vehicles are projected to cost around $30,000 to produce. This efficiency translates to a dramatic reduction in the cost per mile, expected to drop from approximately 60 cents today to as low as 20 cents by the end of 2026. At these rates, the economic incentive to own a personal vehicle vanishes, as autonomous rides become cheaper than the cost of car ownership.

Furthermore, this shift transforms the car from a depreciating asset into a productive investment. Fleet operators and individual owners can potentially generate significant monthly revenue by allowing their vehicles to function as autonomous taxis or delivery units while idle. Beyond individual earnings, the societal impact includes safer roads, as AI systems provide 360-degree situational awareness and more efficient urban planning, as massive parking structures are converted into green spaces or housing. The autonomous era is here, fundamentally altering how we move, earn, and live. 🚘🤖

BITCOIN RESET

The Psychological Shift Beyond the Price of One Bitcoin

The conversation surrounding digital assets often fixates on price, but for those aiming for the "one Bitcoin" milestone, the true significance lies in a profound psychological and systemic shift. At a current valuation of over $85,000, owning a whole unit feels increasingly out of reach for many, yet this pursuit is less about a financial "flex" and more about achieving non-diluted ownership for the first time in history.

Traditional wealth is often measured in percentages of a system that is constantly expanding through currency debasement. In contrast, Bitcoin operates with an absolute supply cap of 21 million units, hard-coded into its network. Reaching one Bitcoin represents owning a fixed portion of that total supply, a piece of a global network that cannot be altered by any committee, corporation, or nation. This realization shifts an investor's mindset from chasing returns to measuring wealth in units that cannot be "messed with".

Furthermore, achieving this milestone often reframes one's relationship with volatility. While many see price swings as a threat, experienced market participants view volatility as a sign of a living, vital system. As institutions enter the space, this volatility is beginning to compress, making the asset increasingly attractive to large capital pools that once viewed it as too risky.

Ultimately, the journey to one Bitcoin is an educational process that rewires how an individual perceives money and value. It fosters a move away from the "paycheck to paycheck" cycle toward a perspective of long term abundance. Once you understand absolute scarcity, the stability of traditional systems begins to look like stagnation, while the vitality of decentralized networks offers a new trajectory for wealth.

Help us spread the word and tell a friend:

Want to advertise with us?

DISCLAIMER:

This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions or investments. Please be careful and do your own research.